The VAT Cash Flow Trap: When "Recoverable" Tax Becomes a 20% Budget Hole

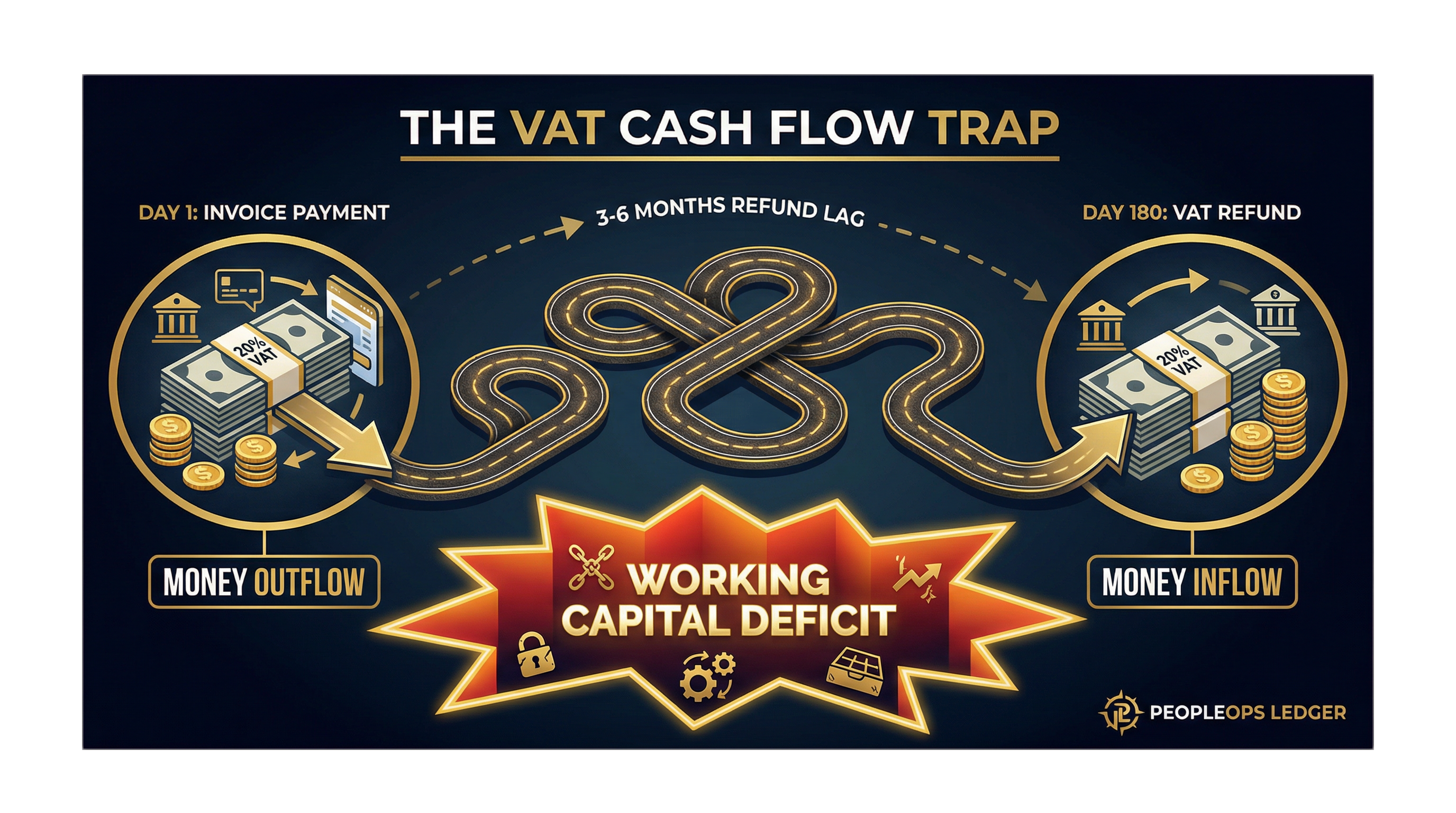

Think VAT is just a pass-through cost? Think again. For US companies, the 3-6 month refund lag creates a massive working capital deficit that EOR sales teams rarely mention.

"Don't worry, it's VAT. You get it all back."

This is the standard line from every EOR salesperson when you ask about the 20-25% tax added to your invoice.

Technically, they are right. Practically, they are leading you into a **cash flow trap** that can freeze 20% of your international payroll budget for half a year.

## The "Recoverable" Myth

Value Added Tax (VAT) in Europe and GST in places like Australia/Singapore is a consumption tax. Business-to-business (B2B) transactions are generally meant to be tax-neutral for the buyer.

However, the *mechanism* of neutrality matters.

If you are a US company with no local entity in the UK, and you hire a UK worker through an EOR: 1. The EOR invoices you $10,000 (Salary + Fees). 2. They add 20% UK VAT ($2,000). 3. **You pay $12,000 immediately.**

Now, you have paid $2,000 in tax that you *should* get back. But how?

Since you are not a UK-registered company, you cannot just "deduct" it from your own VAT return (because you don't have one). You must file a **13th Directive Claim** (for non-EU businesses).

* **The Process:** Paper-heavy, bureaucratic, and slow. * **The Timeline:** It typically takes **3 to 6 months** for the UK HMRC or other tax authorities to process the refund check.

## The Working Capital Gap

This creates a rolling deficit. Every month, you are paying out 20% more cash than your P&L shows as "expense."

If your international payroll is $100k/month: * You pay out $120k cash. * $20k enters the "VAT Black Hole." * By Month 6, you have **$120,000 of cash** sitting in foreign government treasuries, waiting to be refunded.

For a startup or a scale-up, having over $100k of working capital frozen is not a "rounding error"—it's a missed hire, a delayed campaign, or a shorter runway.

## The "Exempt Industry" Nightmare

For some companies, the news is even worse: **You might never get it back.**

If your business operates in a "VAT Exempt" sector—common in **Financial Services (Fintech), Insurance, Healthcare, and Education**—you are often barred from reclaiming VAT on your inputs.

* **The Rule:** If you don't charge VAT on your sales (because your service is exempt), you generally cannot recover VAT on your purchases. * **The Result:** That 20% VAT on your EOR invoice becomes a **hard cost**. Your $100k hire just became a $120k hire, permanently.

EOR sales reps rarely ask about your industry's VAT status. They assume you are a standard SaaS company. If you are a Fintech, this oversight can blow your budget by 20%.

## The Solution: Reverse Charge Mechanism

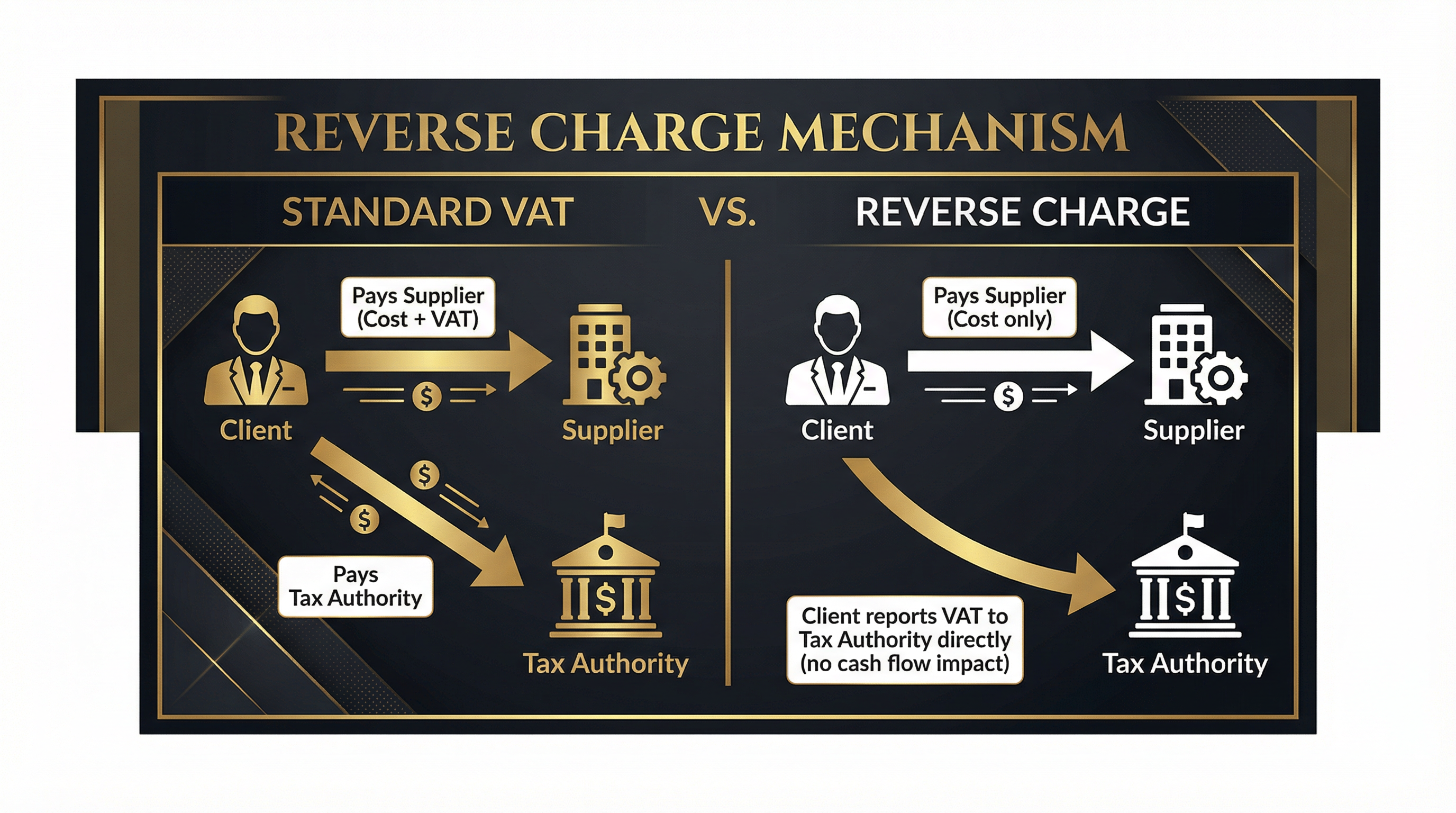

The only way to avoid the cash flow trap is to ensure you never pay the VAT in the first place. This is done via the **Reverse Charge Mechanism**.

Under Reverse Charge, the supplier (EOR) does *not* charge VAT on the invoice. Instead, the buyer (You) essentially "reports" the VAT to the tax authority but immediately deducts it in the same filing. **No cash changes hands.**

* **The Catch:** To use Reverse Charge, you often need a valid VAT ID in the region. * **The Strategy:** For US companies, this might mean registering for a "VAT-only" status in a key hub (like Ireland or Netherlands) if your volume justifies it, or choosing an EOR structure that bills from a jurisdiction where VAT doesn't apply to exports (e.g., US-to-US billing, though this has its own PE risks).

## Vendor Selection Questions

Before signing with an EOR, ask these three questions to stress-test their VAT logic:

1. **"Will you bill me from a local entity or a US entity?"** (Local entity billing often triggers local VAT). 2. **"Can we apply the Reverse Charge Mechanism to these invoices?"** (Force them to check with their tax team, not just the sales rep). 3. **"If we are a Fintech/Healthcare company, is this VAT fully recoverable?"** (Watch them squirm if they don't know the answer).

Don't let "it's recoverable" be the end of the conversation. In the world of cash flow, *when* you recover it matters just as much as *if* you recover it.