The "Shadow Payroll" Compliance Gap: Why Business Travelers Trigger Tax Risks

Sending employees on "workcations" or business trips? You might be triggering "Shadow Payroll" obligations in as little as 30 days. Here is why the 183-day rule is a myth.

"We are fine, they are only there for a month."

This is the most expensive sentence in Global Mobility.

As remote work blurs the line between "vacation" and "relocation," companies are walking into a compliance minefield known as **Shadow Payroll**.

The common belief is the **"183-Day Rule"**: "As long as my employee spends less than 183 days in a country, they are not a tax resident, so we don't have to pay taxes there."

This is a dangerous myth. While 183 days often determines *personal tax residency*, it is **not** the trigger for *employer payroll obligations*.

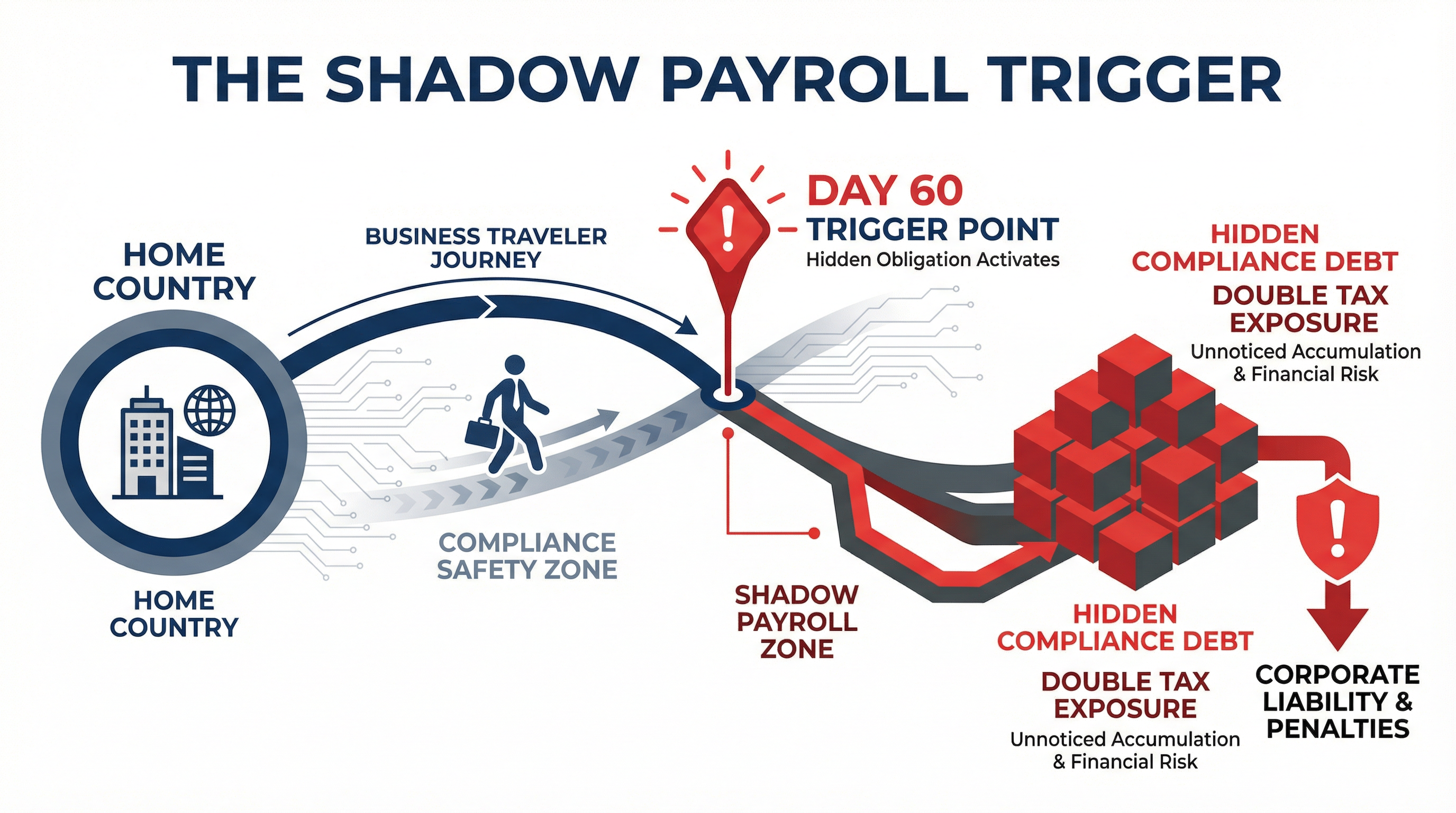

## The Trigger Point is Closer Than You Think

In many jurisdictions, the obligation to report income and withhold tax kicks in much earlier than 183 days.

* **UK:** A "Short Term Business Visitor" arrangement is needed almost immediately. * **Singapore:** Tax clearance is required for non-resident employees working for more than 60 days. * **US States:** Even crossing state lines (e.g., New York to California) can trigger withholding obligations in as little as **1 day**.

When an employee works from a host country, they are technically generating value there. The local tax authority wants its share of the income tax associated with that value creation.

## What is Shadow Payroll?

Shadow Payroll is a reporting mechanism, not a payment method.

The employee continues to be paid in their home country (e.g., US payroll). However, the company must *also* run a "shadow" calculation in the host country (e.g., UK) to determine the hypothetical tax liability there.

1. **Home Payroll:** Pays the net salary to the employee. 2. **Host (Shadow) Payroll:** Calculates taxes due in the host country. The company pays these taxes directly to the local authority.

Crucially, this often leads to **Double Taxation** in the short term. The company pays tax in the US *and* the UK. Later, they (or the employee) must claim a Foreign Tax Credit to get the money back. But the cash flow hit—and the administrative burden—is immediate.

## The "Workcation" Blind Spot

The rise of "Digital Nomad Visas" has confused employers. A visa gives an employee the *right to enter and stay*. It does not necessarily exempt the employer from *payroll tax obligations*.

If your Marketing Director decides to work from Paris for two months this summer: 1. **Corporate Tax Risk:** Their presence could create a "Permanent Establishment" (PE) for your company in France, exposing your global profits to French corporate tax. 2. **Payroll Tax Risk:** You may be required to withhold French social security and income tax from Day 1, depending on the specific tax treaty.

## Why EORs Don't Fix This

Most Employer of Record (EOR) services are designed for **permanent relocation**. They hire the person on a local contract.

They are *not* designed for transient business travelers. If you ask an EOR, "Can I use you for an employee visiting for 2 months?", they will likely say no, or force you to offboard them from your US entity and onboard them to the local entity—a massive administrative headache for a short trip.

## How to Protect Your Company

1. **Track Your Travelers:** You cannot manage what you do not measure. Implement a policy requiring employees to log "work from anywhere" requests. 2. **Check Tax Treaties:** Every country pair is different. The US-UK treaty has different triggers than the US-India treaty. 3. **Know the "Economic Employer" Rule:** Even if the employee is paid from the US, if their work benefits a local entity (e.g., they are fixing a problem for your UK branch), the local entity might be deemed the "Economic Employer," triggering immediate tax liability.

Don't let the 183-day myth lull you into a false sense of security. In the world of global payroll, 30 days is the new 183.