The Equity Grant Trap: Why Stock Options Become Toxic Assets in EOR Models

Granting US stock options to international EOR employees? You might be triggering immediate tax bills for them before they even vest. Here is why "Phantom Stock" is often the safer bet.

"We want our remote team to feel like owners, so we are giving them the same stock options as our US employees."

This sentiment is noble. It is also one of the most dangerous compliance mistakes a startup can make.

When you grant US-style stock options (ISOs or NSOs) to a worker hired through an Employer of Record (EOR), you are not just giving them equity. You are often handing them a **tax time bomb**.

## The "Not an Employee" Problem

The core issue is simple: **Your EOR workers are not your employees.**

Legally, they are employees of the EOR (e.g., Deel, Remote, Oyster). You are a client of the EOR.

Most US equity plans (especially Incentive Stock Options, or ISOs) are strictly reserved for *direct employees* of the issuing company or its subsidiaries.

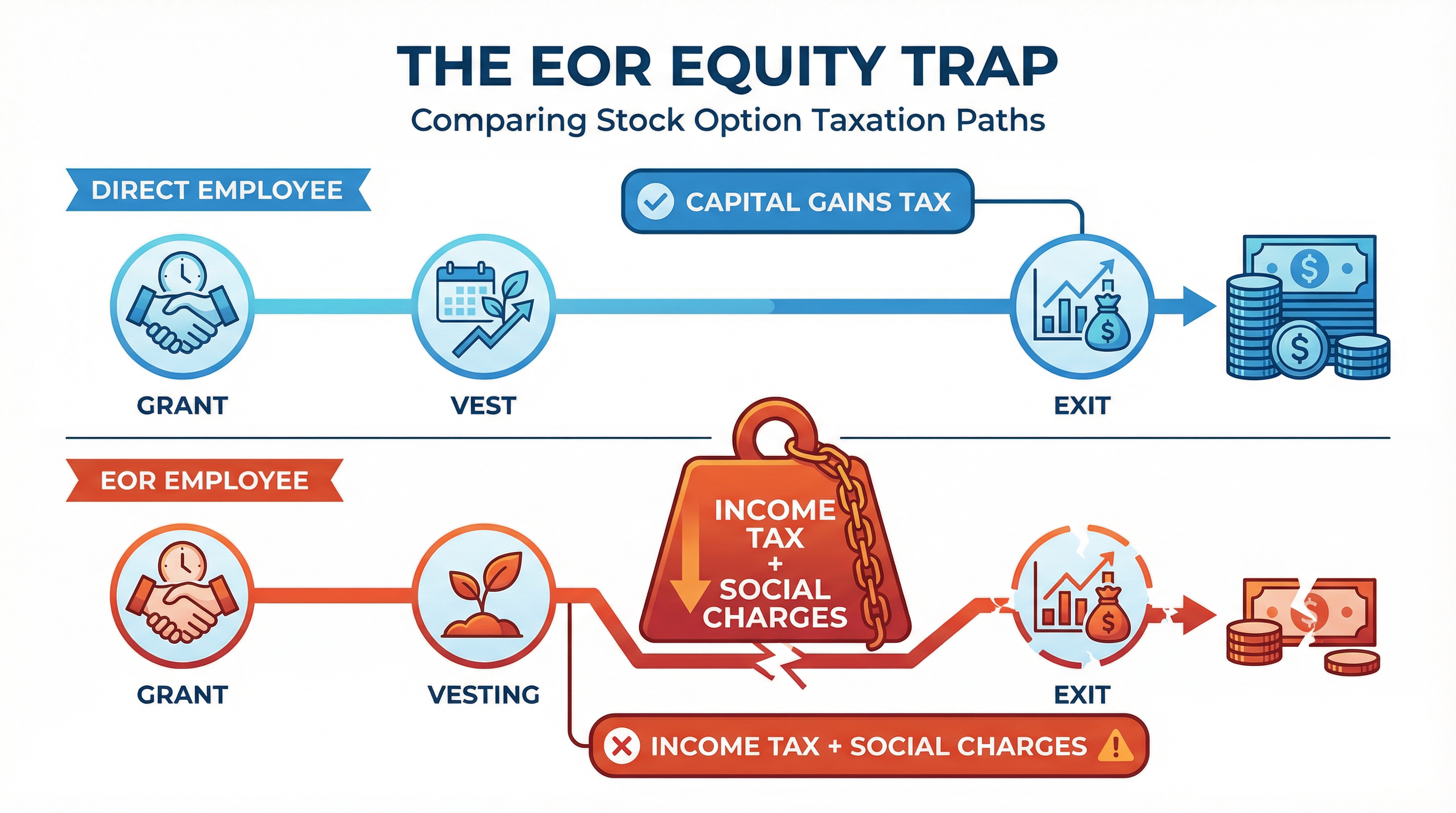

Because the EOR worker is a third-party consultant in the eyes of the IRS and your equity plan: 1. **ISO Disqualification:** They cannot receive ISOs. Any grant automatically defaults to a Non-Qualified Stock Option (NSO). 2. **Tax Timing Mismatch:** In many countries, options granted to non-employees are taxed differently—and often much more aggressively—than options granted to employees.

## The "Dry Tax" Nightmare

In the US, NSOs are generally taxed when you *exercise* them. You pay tax on the difference between the strike price and the fair market value.

But in many other jurisdictions (e.g., Australia, Belgium, Singapore), the tax rules for "consultants" (which is what your EOR worker is to you) can trigger a tax event **at the moment of grant** or **at vesting**, not at exercise.

This creates a "Dry Tax" scenario: * **Scenario:** You grant Maria in Belgium $50,000 worth of options vesting over 4 years. * **The Trap:** The Belgian tax authority might view this grant as an immediate "benefit in kind" derived from her professional relationship with you. * **The Result:** Maria receives a tax bill for thousands of Euros *today*, for shares she cannot sell (and might never be able to sell) for years.

Instead of a retention tool, your equity grant has become a financial liability for your top talent.

## The "Shadow Employment" Risk

There is a second risk, and it falls on *you*, the employer.

By granting equity directly to an EOR worker, you are creating a direct financial link between your parent company and the individual.

Labor courts in countries like Germany, France, and Brazil look at "substance over form." If a worker: 1. Takes daily direction from you. 2. Uses your laptop. 3. **Receives equity directly from your cap table.**

The court may rule that the EOR is a sham and that you are the *de facto* employer. This pierces the corporate veil, exposing you to direct liability for unpaid social security, wrongful termination lawsuits, and permanent establishment risks.

## The Solution: Phantom Stock & SARs

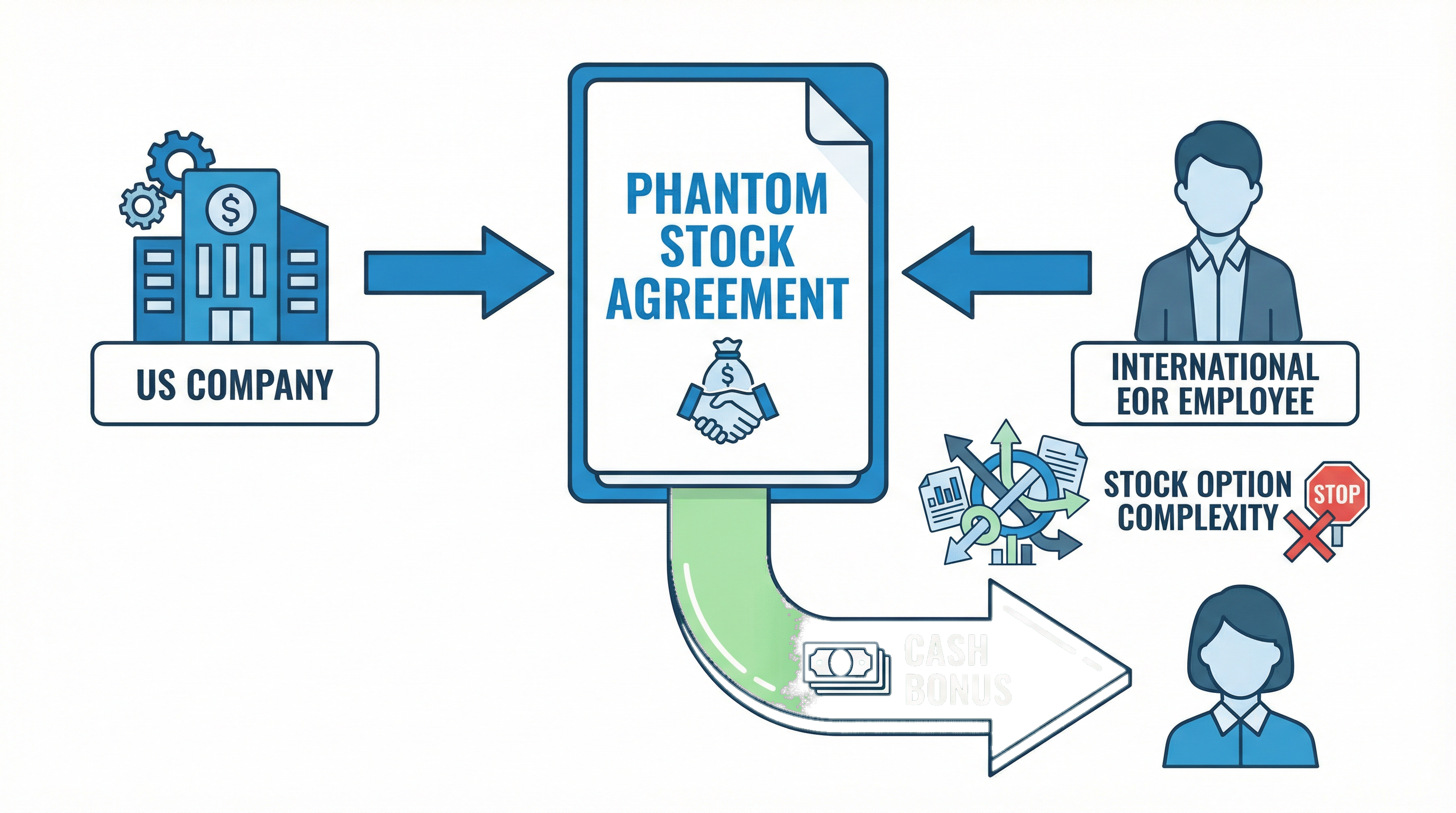

Smart companies do not grant actual options to EOR workers. They use **Phantom Stock** or **Stock Appreciation Rights (SARs)**.

These are contractual bonus plans that *mimic* the economic value of equity without transferring actual ownership.

* **How it works:** "If our stock price goes from $10 to $50, we will pay you a cash bonus of $40 per 'share'." * **The Benefit:** It is treated as ordinary income (salary bonus) in the local country. The EOR can process it through standard payroll, withholding the correct taxes. * **The Safety:** It keeps the worker off your cap table and avoids the "Dry Tax" problem for the employee.

## When to Use What?

| Instrument | Direct Employee | EOR Worker | Why? | | :--- | :--- | :--- | :--- | | **ISO (US)** | ✅ Yes | ❌ No | Legally restricted to employees. | | **NSO** | ✅ Yes | ⚠️ Risky | Can trigger "Dry Tax" & PE risk. | | **Phantom Stock** | ⚠️ Rare | ✅ Best | Safe, compliant, cash-based. |

## Don't Let Generosity Backfire

Equity is a powerful motivator, but only if it has real value. If your equity grant comes with a surprise tax bill and a legal headache, it does the opposite of what you intended: it breeds resentment.

Before you send that Carta invite to your developer in Lagos or Lisbon, pause. Ask your legal team: "Does this grant trigger a tax event at vesting in their country?"

If the answer is "We don't know," switch to Phantom Stock. It is unsexy, but it is safe.